Notice of - “TOSEI Real Estate Crowd TREC FUNDING” - “TREC No.11 Condominium Fund Chitose Funabashi”

- News Release

- Fund

August 28, 2024

TOSEI CORPORATION

To whom it may concern

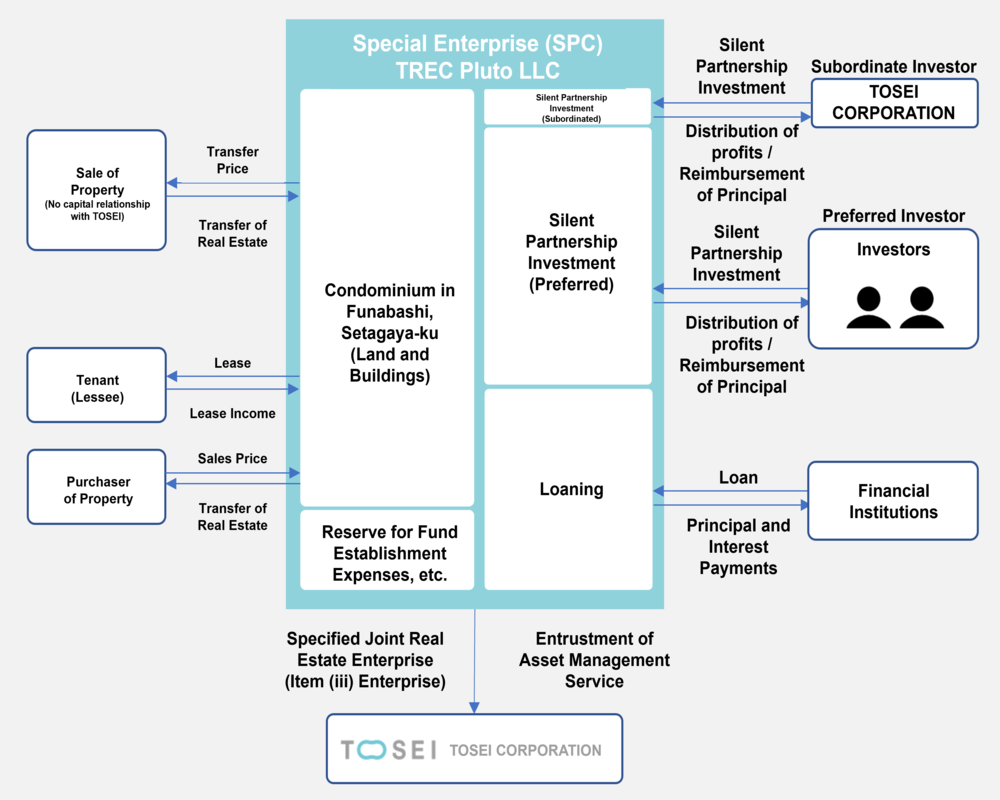

TOSEI CORPORATION (Head Office: Minato-ku, Tokyo; President and CEO: Seiichiro Yamaguchi; Securities Code: 8923) (the"TOSEI") is pleased to announce that, on August 28, we released information regarding "TREC No. 11 Condominium Fund Chitose Funabashi, Setagaya-ku, Tokyo" (the "Fund") which is the eleventh fund of the "TOSEI Real Estate Cloud TREC FUNDING" real estate crowdfunding though which you can make online investments in real estate. Only investors that are residents of Japan are permitted to invest in the Fund and use our services related to investing in the Fund. Investors that are non-residents of Japan are not permitted to invest in the Fund or otherwise receive our services, so we cannot accept investment requests from any investors that are non- residents of Japan.

Fund Overview

|

Fund Name: |

TREC No.11 Condominium Fund Chitose Funabashi |

|---|---|

|

Property Type: |

One building profitable condominium |

|

Total Amount of Fund: |

555.4 million yen |

|

Amount of Offering (Preferred Investment): |

257.2 million yen |

|

Expected Distribution Rate: |

6.5%

|

|

Scheduled Operation Period: |

2 years (Seprember 30, 2024 - September 29, 2026) |

|

Minimum Investment Amount: |

10,000 yen (10,000 yen per unit x 1 unit) |

|

Offering Period (Scheduled): |

August 30 (Fri) 2024, 12:00 p.m. - September 12 (Mon) 2024, 12:00 a.m. |

|

URL for Details: |

Located in Setagaya-ku, a popular area to live

The Fund will acquire and manage the land and building of a single condominium located in Funabashi, Setagaya-ku, Tokyo. The subject property consists of total 26 units (1K and 1R type) and is intended for single persons. The Chitose Funabashi area where the subject property is located has long been known as a safe and quiet residential area, and offers a comfortable living environment with shopping streets, parks, medical facilities, and public facilities.

As of August 2024, 23 of the 26 units are leased, and 3 units are vacant. We will conduct leasing activities for the vacant units as soon as possible after acquisition, aiming to increase rents and achieve full occupancy at the earliest possible date. For leased units, we will strive to improve cash flow by revising rents to appropriate levels at the time of contract renewal.

Through these initiatives, we will strive to maximize the value of the property, and in addition to the distribution of income during the period from rental income, we will eventually sell the property and distribute profits from the sale. If an opportunity presents itself, we may sell the property without waiting for the scheduled operation period and redeem the property early. We are planning to minimize the period until the termination of management (i. e., completion of the sale of the property), to extent possible, and improve the investment efficiency of the investment made by our investor.

The Fund Characteristics

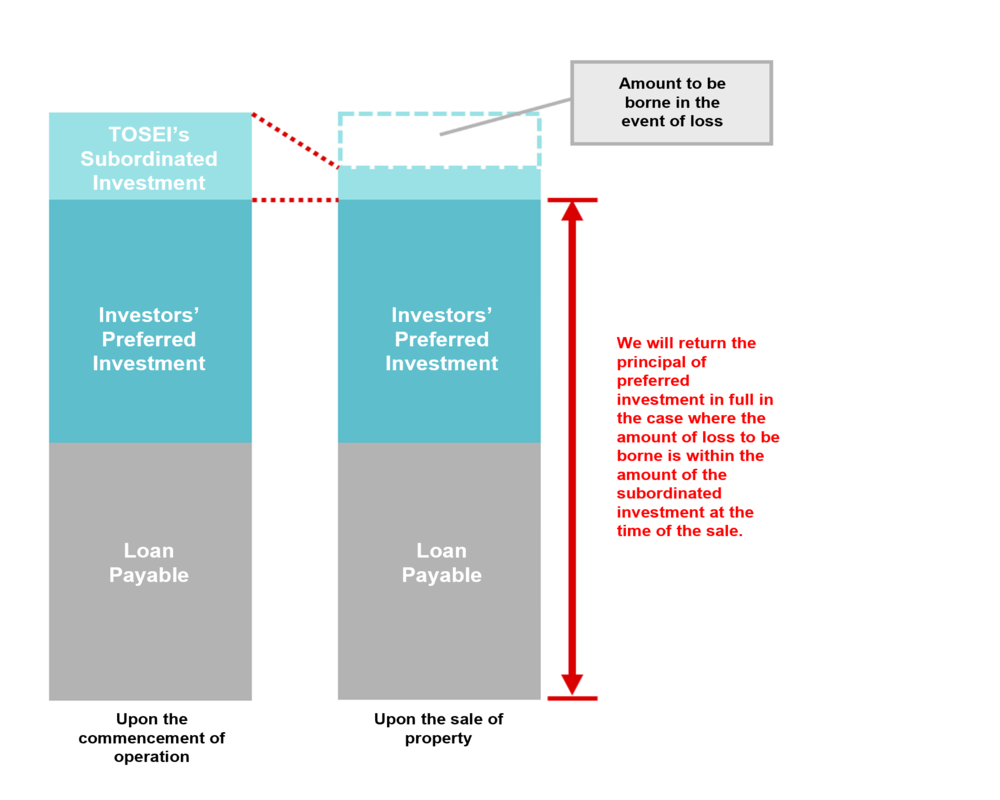

Adoption of preferred/subordinated investment structure

With respect to the Fund, TOSEI will make a subordinated investment to thereby enhance the safety of the principal of the preferred investment made by our investors. In the event of any loss arising from the real estate management, such loss will first be borne by the subordinated investor. Therefore, if the loss is within subordinated investment amount, the principal of the preferred investment will not be impaired.

Please carefully confirm and consider the details of the Fund before making an investment decision.

Leverage Effect

With respect to the Fund, we will loan from domestic financial institutions. By leveraging, the Fund aims to achieve a relatively high investment yield.

TOSEI Real Estate Crowd TREC FUNDING will continue to strive to plan products that meet our investors' expectations and improve our services.

- Website Name:

- TOSEI Real Estate Crowd"TREC FUNDING"

* TREC stands for "TOSEI Real Estate Crowd" - Concept:

- Achievement and confidence in real estate business - Start real estate crowdfunding with TOSEI

- Website URL:

- Membership Registration URL:

-

*To invest via "TREC FUNDING" you need to register as a member and take the relevant bank account opening procedure, etc. Please note that there are conditions to invest via TREC FUNDING as stated at the beginning of this release.

Indications under the Financial Instruments and Exchange Act, and the Real Estate Specified Joint Enterprise Act

- 1. Trade Name, Registration Number and Memberships

- Trade Name: TOSEI CORPORATION

Financial Instruments Business Registration No.: Director-General of Kanto Local Finance Bureau (Financial Instruments) No. 898

Type of Financial Instruments Business: Type II Financial Instruments Business; Investment Advisory and Agency Business

Memberships: Type II Financial Instruments Firms Association; Japan Investment Advisors Association

Real Estate Specified Joint Enterprise Operator License No.: Commissioner of the Financial Services Agency, Minister of Land, Infrastructure, Transport and Tourism No. 102

Type of Real Estate Specified Joint Enterprise : Item (i) Enterprise; Item (iii) Enterprise; Item (iv) Enterprise (The Items (i) and Item (iv) Enterprise include Electronic Trading Services)

Representative: Seiichiro Yamaguchi, President and CEO

Business Manager: Hitoshi Ohshima, Service Manager, Head Office - 2. Investment Risks and Fees

- Neither yield nor principal is guaranteed for the equity in any investment in a silent partnership that we handle in this service, and there are risks, such as a loss of the principal of the investment. In principle, the equity of an investment in a silent partnership cannot be transferred to a third party or cancelled unless there are unavoidable circumstances. Therefore, it is possible that you will not be able to transfer or cancel the equity of your investment in a silent partnership at the time of your request and therefore cannot convert the same into cash. The fees and risks will vary depending on the fund. For more details, please refer to the details of each fund on our website and the Documents Prior to the Conclusion of a Contract that are to be delivered.

- 3. Type of Real Estate Specified Joint Enterprise Contract and Manner of Transaction

- Type of Contract: Contract as set forth in Article 2, Paragraph (3), Item (ii) of the Real Estate Specified Joint Enterprise Act.

Manner of Transaction: Treatment of offering (acting as an agent or intermediary in concluding a Real Estate Specified Joint Enterpris Contract to which a Special Enterprise is a party)

-

*The Japanese version of this website shall be the original, and this English version has been prepared for reference purposes only. In the event of any discrepancy or inconsistency between these two versions, the Japanese version shall prevail (provided, however, that this shall not apply to any discrepancy or inconsistency for any matter relating to the scope of investors or the scope of provision of our services first written above).

- Company Name

-

Tosei Corporation

https://www.toseicorp.co.jp/english/ - President and CEO

- Seiichiro Yamaguchi

- Address

- 4-5-4 Shibaura, Minato-ku, Tokyo

- Fields of Business

- Real estate revitalization, real estate development, real estate rental, real estate funds and consulting, real estate management, hotel business

Corporate Management Department

Public Relation / Sustainability Promotion Section

Tosei Corporation