Corporate Governance

Fundamental Approach Toward Corporate Governance

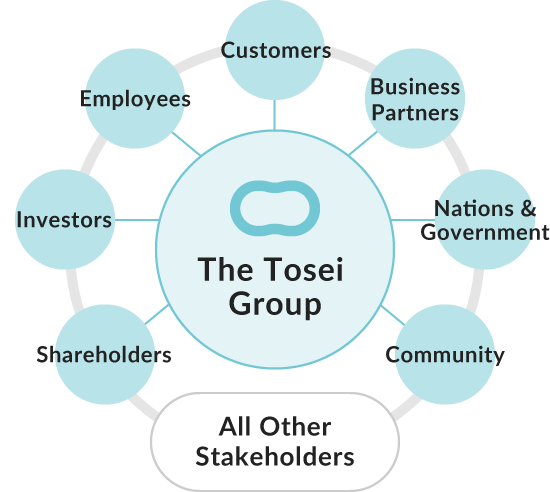

Our Group aspires to be a valuable contributor to all of our stakeholders in society including the shareholders, the employees, the business partners and others, by promptly and appropriately responding to the changes in the business environment and continuing operational activities which enable the Group to achieve a sound growth. For this purpose, the Group has placed the greatest importance on enhancement of corporate governance, and in particular, fully cultivating a compliance mindset, enhancing risk management and conducting timely disclosure as three key initiatives. Furthermore, the Group is determined to make efforts in a unified manner, from the top management down to each employee of the Group companies, led by the Board of Directors, to develop an internal control system as required by the Companies Act and the Financial Instruments and Exchange Act, as well as to set up a system which is credible to investors, as a financial instruments business operator.

Three Important Items in Corporate Governance

-

Compliance

We place compliance at the top of our agenda and raise awareness of it from top management to all employees of the Group companies.

-

Risk Management

Assuming every possible risk, we prepare and practice responses under normal times and emergencies.

-

Information Disclosure

We practice disclosure and communication appropriately and on a timely basis to all stakeholders including shareholders.

Basic Policy on Corporate Governance

Corporate Governance Report

Corporate Governance System

Reasons for Adopting the Current Corporate Governance System

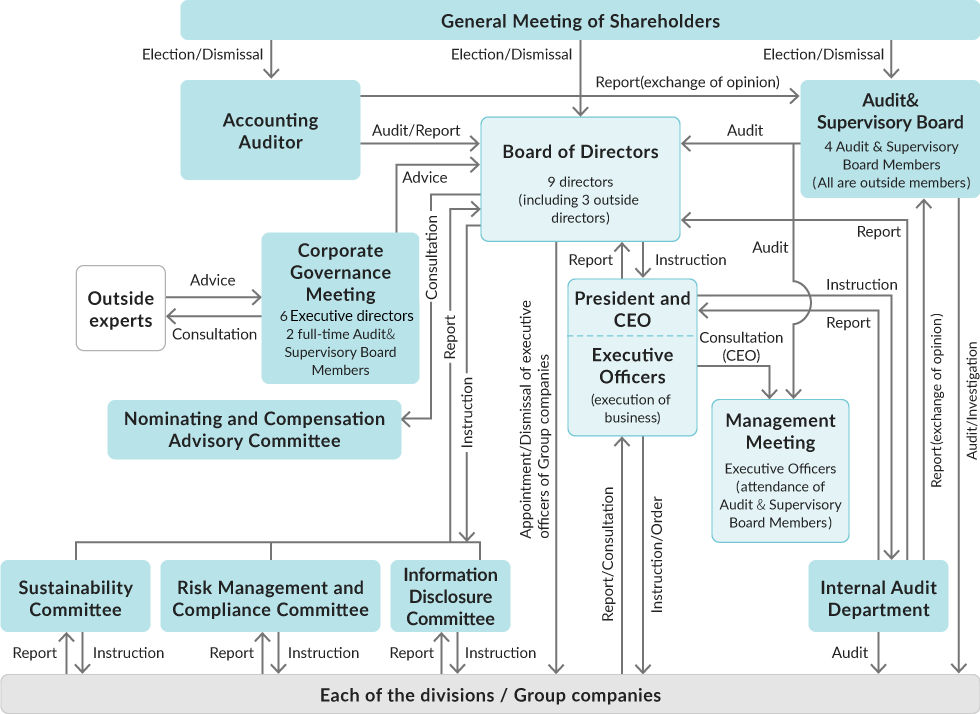

The Company has set up the Board of Directors and the Audit & Supervisory Board. While appointing from outside its outside directors and all of its Audit & Supervisory Board members, it has also adopted an executive officer system, for the purpose of operating its businesses with high transparency. All of the Audit & Supervisory Board members of the Company have been outside Audit & Supervisory Board members since the time of listing. The Audit & Supervisory Board members have always performed audits of the business management of the Company from the viewpoints of ensuring and increasing the Company's corporate value and the common interests of its shareholders. The Company further enhances its supervisory function over its management by inviting outside directors to the Board of Directors. On the management side, the Company has employed the executive officer system so as to achieve optimal distribution of decision-making functions and operational duties, as well as encouraging the delegation of authority in executing the businesses, in an attempt to strengthen its corporate governance.

Board of Directors

The Board of Directors is composed of nine directors, three of whom are outside directors. Based on the regulations of the Board of Directors, regular meetings of the Board of Directors are held every month and extraordinary meetings are held as necessary. As the highest management decision-making body, the Board of Directors makes resolutions on management policy and important matters, and also supervises the execution of duties by directors. In addition, outside directors (independent directors) offer advice and suggestions to help secure adequate and appropriate decision making by the Board of Directors by stating opinions from an objective standpoint and taking other measures.

Nominating and Compensation Advisory Committee

The Company has set up the Nomination and Compensation Advisory Committee as a voluntary advisory body for the Board of Directors for the purpose of ensuring appropriateness and transparency of each resolution of the Board of Directors on the process of selecting candidates proposed in a proposal for appointing directors that is submitted to the General Meeting of Shareholders and on allocation of remuneration, etc. for individual directors. The constituent members of the committee include outside director(s) (independent director(s) , one person or more) , a full-time audit & supervisory board member (outside audit & supervisory board member, one person) , a representative director (one person) , and an Executive director (one person) . An outside director who is a committee member will assume the office of the chair of committee.

To monitor the legality of each decision-making process, the Company's Basic Policy on Corporate Governance stipulates that the committee shall include an independent outside Audit & Supervisory Board member and that independent Outside Directors and independent outside Audit & Supervisory Board members shall be a majority of the committee. To ensure the independence and objectivity of the committee, four of the six committee members are independent officers, and the chairperson is an independent Outside Director.

Audit & Supervisory Board

The Company has adopted the Audit & Supervisory Board member system and has the Audit & Supervisory Board with two full-time and two part-time Audit & Supervisory Board members, all of whom are outside Audit & Supervisory Board members. They audit the operation of the Board of Directors and execution of duties of Directors from an independent and objective standpoint, and provide constructive advice and recommendations for the increase of corporate value with their knowledge.

Executive Officer System

The Company has adopted the executive officer system in order to more clearly segregate the monitoring / supervision of the Company's business management, which is the duty and responsibility of the directors, from the execution of the business. The executive officers are appointed at the board meetings and will adhere to the Company's internal rules and regulations as well as to the resolutions of the Board of Directors in executing and controlling the business operations of the Company. In addition, the representative director and president has assumed the position of the chief executive officer and holds the management meetings twice a month as a general rule to seek for consultation on the material issues to be decided by him, and to discuss the matters to be resolved at the board meetings in advance.

Corporate Governance Meeting

With the aim of continuously strengthening of corporate governance, the Company holds corporate governance meetings consisting of Executive Directors and full-time Audit & Supervisory Board Members. At the meetings, the Directors and the Audit & Supervisory Board Members check and deliberate over corporate governance concerns for improving corporate value and items regarding internal control. Where necessary, the Company receives advice from outside experts such as corporate attorneys and certified public accountants.

Cooperation Among the Audits by Audit & Supervisory Board Member, Internal Audit Member, and Audits by Accounting Auditors (Three-pronged Auditing Structure)

|

Audits by corporate auditors |

The auditing activities by the Audit & Supervisory Board members are performed in accordance with an annual audit plan. By cooperating with the accounting auditors as well as with the Internal Auditing Department, the Company has developed an efficient and viable auditing system. The full-time Audit & Supervisory Board members holds regular meetings with each of the directors and officers in charge of each department to fully understand the status of the business execution as well as to regularly exchange opinions with the outside directors. |

|---|---|

|

Internal audits |

The Internal Audit Department under the direct supervision of the chief executive officer, performs audits for the entire Group's overall business activities from the perspective of legality and adequacy, etc. in accordance with their annual auditing plan. In the event any inadequacy is discovered, recommendations for corrective actions are made to the audited departments. The internal Audit Department discusses with the audited departments for issues in need of corrective actions, and follows up with specific guide which leads to the provision of effective audits. |

|

Audits by the accounting auditor (Shinsoh Audit Corporation) |

The audit of the Company's accounts is performed based on the annual audit plan. In addition to the full-year audit performed at the end of the fiscal year, Company's Audit Company (Shinsoh Audit Corporation) conducts reviews at the end of each quarter. The periodic replacement and re-engagement of the accounting auditor in accordance with the rules and regulations of the audit corporation under the Certified Public Accountants Act are operated as follows;

|

Constituent Member by Board (as of Feb. 27, 2025)

(◎Chairperson, 〇Constituent member, △Observer)

スクロール

| Name | Position | Attribute | Meeting of Board of Directors | Audit & Supervisory Board | Nominating and Compensation Advisory Committee | Corporate Governance Meeting |

|---|---|---|---|---|---|---|

| Seiichiro Yamaguchi | President and CEO |

|

|

|

||

| Noboru Hirano | CFO and Senior Executive Officer |

|

|

|

||

| Hideki Nakanishi | Director, COO and Senior Executive Officer |

|

|

|||

| Shunsuke Yamaguchi | Director, Managing Executive Officer |

|

|

|||

| Hiroyasu Yoneda | Director, Managing Executive Officer |

|

|

|||

| Shigehiro Takami | Director, Executive Officer |

|

|

|||

| Kenichi Shohtoku | Outside Director | Independent |

|

|

||

| Hiroyuki Kobayashi | Outside Director | Independent |

|

|

||

| Mai Ishiwatari | Outside Director | Independent |

|

|

||

| Hitoshi Yagi | Outside Audit & Supervisory Board member (full-time) | Independent |

|

|

|

|

| Toshinori Kuroda | Outside Audit & Supervisory Board member (full-time) | Independent |

|

|

|

|

| Tatsuki Nagano | Outside Audit & Supervisory Board member | Independent |

|

|

||

| Satoshi Ikeda | Outside Audit & Supervisory Board member | Independent |

|

|

Attendance of Each Constituent at Meetings of the Board of Directors, Nomination and Compensation Advisory Committee

FY 2024 (December 1, 2023 - November 30, 2024)

スクロール

| Name | Position | Board of Directors Meetings (Attendance/Number of meetings) | Nominating and Compensation Advisory Committee (Attendance/Number of meetings) | Audit & Supervisory Board (Attendance/Number of meetings) |

|---|---|---|---|---|

| Seiichiro Yamaguchi | President and CEO | 22/22 | 5/5 | - |

| Noboru Hirano | CFO and Senior Executive Officer | 22/22 | 5/5 | - |

| Hideki Nakanishi | Director, COO and Senior Executive Officer | 22/22 | - | - |

| Masaaki Watanabe *1 | Director, Managing Executive Officer | 7/7 | - | - |

| Shunsuke Yamaguchi | Director, Executive Officer | 22/22 | - | - |

| Hiroyasu Yoneda *2 | Director, Managing Executive Office | 15/15 | - | - |

| Hitoshi Oshima | Director, Executive Officer | 22/22 | - | - |

| Kenichi Shohtoku | Outside Director | 22/22 | 5/5 | - |

| Hiroyuki Kobayashi | Outside Director | 21/22 | 5/5 | - |

| Masao Yamanaka *1 | Outside Director | 7/7 | 3/3 | - |

| Mai Ishiwatari *2 | Outside Director | 14/15 | 2/2 | - |

| Hitoshi Yagi | Outside Audit & Supervisory Board member (full-time) | 22/22 | 5/5 | 16/16 |

| Toshinori Kuroda | Outside Audit & Supervisory Board member (full-time) | 22/22 | - | 16/16 |

| Tatsuki Nagano | Outside Audit & Supervisory Board member (part-time) | 20/22 | - | 15/16 |

| Osamu Doi | Outside Audit & Supervisory Board member (part-time) | 22/22 | - | 16/16 |

-

*1Attendance until their retirement on February 27, 2024.

-

*2Attendance since their appointment on February 27, 2024.

Policy for Appointment of Directors

Basic Policy

The Board of Directors places importance on diversity in terms of gender, internationality, work experience, age, etc., and is comprised of Directors who are familiar with the Group's philosophies, the details of finance and business, etc., Directors overseeing management from an objective standpoint, and Independent Outside Directors having a wide range of experience and knowledge, and being independent.

When nominating candidates for Executive Directors, those who have the necessary knowledge as Directors and are familiar with the Group's finances, business, and other aspects of the Group are nominated for Directors who execute the business. For Directors other than Executive Directors (including Outside Directors) , appoints persons who can oversee the management from an independent and objective standpoint and be expected to provide constructive advice and recommendations to Executive Directors. The candidates are determined based on the result of discussion regarding appropriateness of nomination of candidates at the Nominating and Compensation Advisory Committee.

In addition, for the nomination of candidates for the Audit & Supervisory Board members, the Company has a basic policy to nominate persons who can audit the operation of the Board of Directors, execute duties of directors from an independent and objective standpoint, and provide constructive advice and recommendations to enhance corporate value with their knowledge. The Board of Directors determines the candidates based on the result of discussion at the Nominating and Compensation Advisory Committee with the consent of the Audit & Supervisory Board. The Audit & Supervisory Board members of the Company are all appointed from outside since the time of listing.

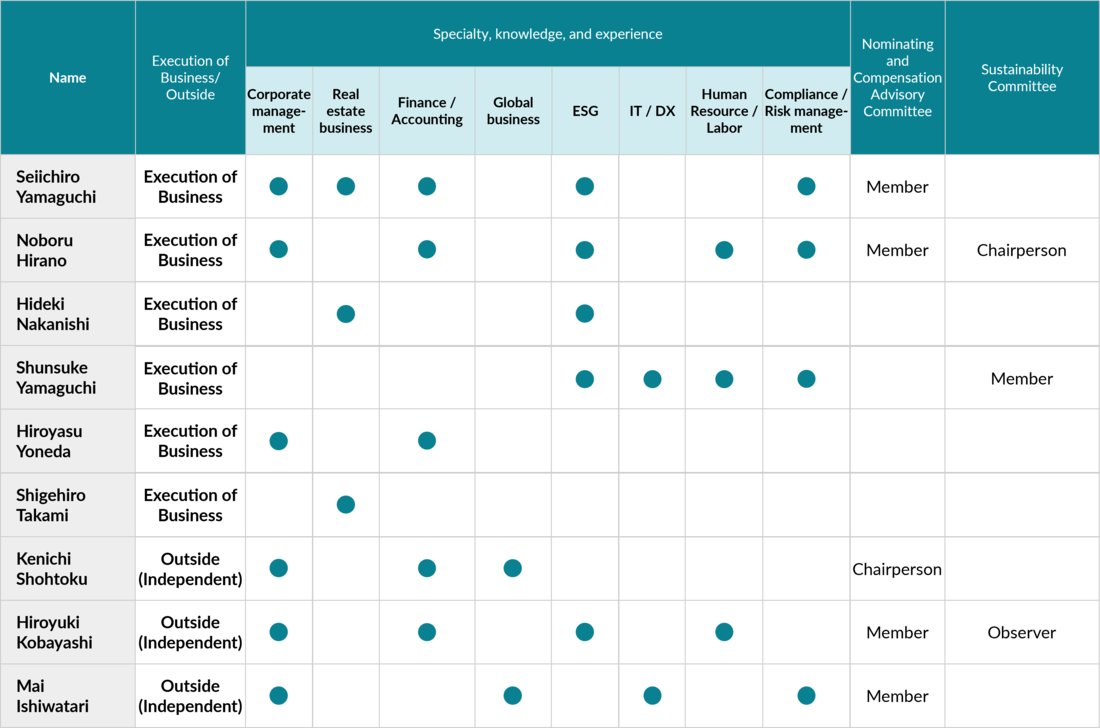

Skill Matrix for the Board of Directors

The Company nominates candidates for Directors who have high levels of expertise, with an eye on the balance of knowledge, experience, and competence within the Board of Directors as a whole and the composition of the Board of Directors that considers diversity and scale.

Status of Independent Officer

The Company appoints Outside Directors and Outside Audit & Supervisory Board Members based on the Independence Standards established by the Company, in addition to the independence standards established by the Tokyo Stock Exchange. Furthermore, in electing independent outside directors, a person who has a wide range of experience and knowledge, and can provide frank, lively, and constructive opinions, advice, and recommendations at meetings of the Board of Directors is nominated. The Company's Independence Standards are stated in the Tosei Corporation Basic Policy on Corporate Governance.

Reasons for Election of Outside Directors and Outside Audit & Supervisory Board Members

Reasons for Election of Outside Directors

Scroll

| Name | Independent Officer | Reason for the election |

|---|---|---|

| Kenichi Shohtoku |

|

Outside Director Kenichi Shohtoku, a certified public accountant, he has an extensive experience and knowledge including those relating to overseas business. He has provided invaluable advice on various occasions such as the Board of Directors' meetings of the Company, liaison meetings with the Audit & Supervisory Board Members of the Company, etc. and has worked energetically to enhance the governance system of the Company and the Group as well as to ensure the appropriateness of financial reporting. The Company considers that he is indispensable for the maintenance and improvement of corporate governance structure for further expansion of the Group and enhancing the checking functions in the future while paying attention to ESG issues. |

| Hiroyuki Kobayashi |

|

Outside Director Hiroyuki Kobayashi, has extensive experience and expert knowledge, accumulated mainly at major financial institutions. With his objective monitoring and proposals based on his abundant experience and expertise, he has been contributing to more active discussion at Board of Directors meetings and improvement of its effectiveness. The Company considers that he is indispensable for the maintenance and improvement of corporate governance structure for further expansion of the Group and enhancing the checking functions in the future while paying attention to ESG issues. |

| Mai Ishiwatari |

|

Outside Director Mai Ishiwatari possesses a high level of expertise and global knowledge of corporate legal affairs accumulated mainly at domestic and international law firms. Accordingly, we believe that she will be able to provide objective supervision and proposals that will contribute to legal compliance of the Group's business. Furthermore, she has been involved in corporate management at multiple companies in recent years. The Company believes that she will be able to contribute to the Group's further growth and enhancement of corporate governance by adopting her external viewpoint based on her knowledge and experience to ensure neutrality in management. |

Outside Audit & Supervisory Board Members

Scroll

| Name | Independent Officer | Reason for the election |

|---|---|---|

| Hitoshi Yagi |

|

Full-time Outside Audit & Supervisory Board member Hitoshi Yagi has extensive experience in the auditing divisions of major financial institutions and professional insight based on his qualifications as a Certified Internal Auditor (CIA) and a Certified Information Systems Auditor (CISA) . Utilizing such experience and knowledge, the Company believes that he can perform his role to ensure the adequacy and appropriateness of the Company's management. |

| Toshinori Kuroda |

|

Full-time Outside Audit & Supervisory Board member Toshinori Kuroda has abundant experience at major financial institution as well as specialist knowledge based on his qualification as Master of Business Administration (MBA) and Certified Internal Auditor (CIA) . Utilizing such experience and knowledge, the Company believes that he can perform a role in ensuring the adequacy and appropriateness of the Company's management. |

| Tatsuki Nagano |

|

Outside Audit & Supervisory Board member Tatsuki Nagano has experience at major financial institutions and continues to be involved in corporate management. Based on his extensive experience and high level of expert insight, the Company believes he can perform a role in ensuring the adequacy and appropriateness of the Company's management. |

| Satoshi Ikeda |

|

Outside Audit & Supervisory Board Member Satoshi Ikeda will contribute to the Company in ensuring the adequacy and appropriateness of the business management of the Company with his high level of expertise in corporate legal affairs as an attorney, as well as his extensive financial knowledge based on his experience working at a major financial institution and his insight on system development. |

Independent Officers' Remuneration

Outline of the Remuneration System for Directors and Policy for Determining Remuneration

The Company has a basic policy to properly determine remuneration, through a combination of fixed remuneration based on job responsibility, a performance-based bonus, stock options that allow exercise of rights after a certain period, and the Company's share-based compensation depending on the performance result of a certain period in order to realize the medium- to long-term growth of the Group.

Remuneration for Executive Directors consists of monetary remuneration, comprising a fixed salary which is scaled according to duties, performance evaluation remuneration which is based on the achievement of individual goals such as the performance of each Executive Director, and Directors' bonuses which are linked to consolidated profit before tax, share-based compensation which are linked to consolidated profit before tax, and stock options which are aimed to increase the desire and motivation to contribute to the medium- to long-term enhancement of corporate value.

Due to the emphasis on their supervisory function from a standpoint independent of the execution of business, Outside Directors' remuneration is composed of a fixed salary, share-based compensation which amount is fixed, and stock options only. No performance evaluation remuneration or directors' bonuses are paid to Outside Directors.

The representative director and president drafts proposals for each Director's remuneration within the limit, which are discussed by the Nomination and Compensation Advisory Committee, before being decided by resolution of the Board of Directors.

Officers' Remuneration System

スクロール

| Position | Fixed salary | Short-term Incentive | Medium- to Long-term Incentives | ||

|---|---|---|---|---|---|

| performance-linked renumeration * | Non-monetary remuneration | ||||

| performance evaluation remuneration | directors' bonuses | share-based compensation (restricted share-based compensation) | Stock Options | ||

| Executive Directors | 〇 | 〇 | 〇 | 〇 | 〇 |

| Outside Directors | 〇 | - | - | 〇 (fixed amount) |

〇 |

| Audit & Supervisory Board members | 〇 | - | - | - | - |

-

*The ratio of fixed salary to performance-linked renumeration (including share-based compensation) for Executive Directors is approximately 60:40.

Fixed Salary

On the basis of comparisons with the results of surveys of Directors' remuneration at listed companies, conducted by external specialist agencies, and surveys of the levels of Directors' remuneration at the Company's competitors, conducted by the Company, as well as comparison with the highest amounts of remuneration paid to employees of the Company, the Company has established fixed salary scaling guidelines, based on Directors' duties and posts held by Directors concurrently serving as Executive Officers. Remuneration for each individual Director is discussed by the Nomination and Compensation Advisory Committee, before being decided by the Board of Directors.

Performance Evaluation Remuneration (Performance-linked Renumeration)

The performance evaluation remuneration for Executive Directors is based on their individual achievement of single-year performance targets. A standard evaluation remuneration amount equal to 33% of the fixed salary is paid monthly together with the fixed salary. Where there is an adjustment based on the achievement of performance targets (of between +55% and -50% of the standard evaluation remuneration) , this is added to and paid together with Directors' bonuses or deducted from Directors' bonuses after the conclusion of the Ordinary General Meeting of Shareholders held during the fiscal year. Remuneration for each Director is evaluated by the Nominating and Compensation Advisory Committee, where the level of contribution to the governance practices and the pursuit of sustainability of the Company as well as the Group as a whole, achievement of the department in charge, and degree of maintenance / improvement of consolidated management indicators (ROE, stock price, etc.) .

Director's Bonuses (Performance-linked Renumeration)

Executive Directors' bonuses are determined based on the pre-determined level of consolidated pretax profit, plus an additional amount if the consolidated pretax profit target for a single fiscal year is achieved and are paid after the close of the Ordinary General Meeting of Shareholders for the relevant fiscal year. As a director of a listed company, engaged in consolidated management, maintaining and increasing the level of consolidated profit before tax and achieving the pre-tax profit target for each fiscal year are important missions, therefore the Company has adopted this indicator.

Share-based Compensation

- Share-based Compensation (Performance-linked Renumeration for Executive Directors)

- In order to clarify the linkage between remuneration for Executive Directors and the Company's business performance and share value, and to continuously improve the Company's corporate value, share-based compensation for Executive Directors is granted in the form of a number of ordinary shares of the Company after the close of the Ordinary General Meeting of Shareholders for the relevant fiscal year, corresponding to an amount determined according to the level of consolidated pre-tax profit for a single year predetermined by the Board of Directors after discussion at the Nomination and Compensation Advisory Committee, plus an additional amount if the consolidated pretax profit target for a single fiscal year is achieved.

- Share-based Compensation (Fixed salary for Outside Directors)

- In order to continuously improve the Company's corporate value, share-based remuneration for Outside Directors is granted in the form of the Company's ordinary shares after the close of the Ordinary General Meeting of Shareholders for the relevant fiscal year, subject to the achievement of the amount of consolidated pre-tax profit for a single fiscal year predetermined by the Board of Directors after discussion at the Nomination and Compensation Advisory Committee.

The ordinary shares granted to Executive Directors and Outside Directors are subject to certain transfer restrictions such as the restriction to transfer until the date of their resignation from the position as Directors or Executive Officers of the Company. Furthermore, for these individuals, the Company may forfeit (malus) the rights to receive the delivery of shares in the event of a serious violation of laws or internal rules and regulations.

Stock Options

Stock Option for Executive Directors is in order to pursue corporate management with a focus on enhancing corporate value over the medium- to long-term, the President and Representative Director drafts proposals for the number of stock options to be granted to each Director, based on the Director's duties as well as posts held concurrently by the Director as Executive Officer, for each medium-term management plan. These proposals are examined by the Nomination and Compensation Advisory Committee, before being decided by the Board of Directors. A fixed number of stock options are also granted to Outside Directors, considering the importance of their management monitoring and supervisory function aimed at enhancing corporate value.

Auditor's Remuneration

Audit & Supervisory Board members, considering their role, are remunerated with a fixed salary only. Remuneration for each Audit & Supervisory Board member is decided through discussion of the Audit & Supervisory Board, within the limits of the maximum total amount.

Amount of Remuneration for Executive Officers (FY2023)

スクロール

| Position | Total amount of remuneration,etc. [¥ thousand] | Total amount by type of remuneration, etc. [¥ thousand] | Number of recipients [Person] | ||||

|---|---|---|---|---|---|---|---|

| Basic remuneration | Performance-linked remuneration | Non-monetary remuneration, etc. | |||||

| Performance evaluation remuneration | Bonus | Share-based Compensation | Stock Options | ||||

| Directors (of which outside directors) | 323,369 (20,872) |

175,017 (19,803) |

51,738 (-) |

48,066 (-) |

42,894 (738) |

5,652 (330) |

11 (4) |

| Audit & Supervisory Board members (of which outside audit & supervisory board members) | 34,863 (34,863) |

34,863 (34,863) |

- (-) |

- (-) |

- (-) |

- (-) |

4 (4) |

-

*The number of eligible Directors and the amount of remuneration in the table above includes one retired Executive Director and one retired Outside Director.

-

*The ratio of fixed remuneration to performance-linked remuneration for Executive Directors is kept around 60:40 and for the 75th term, the ratio was 52:48.

Total amount of consolidated remuneration, etc. (only for officers for whom the total amount of remuneration, etc. is ¥100 million or more) by each officer of the Company is stated in the Annual Securities Report for the Fiscal Year Ended November 30, 2024, released on February 27, 2025.

Internal Control System

The Company has established a Basic Policies of Internal Control Systems by resolution of the Board of Directors, and under this basic policies, in a continuous effort to develop the internal control system, the Company establishes plans for implementation and operation of the internal control system annually taking into consideration of revisions of relevant laws and regulations, changes in the business environment of the Group, expansion of the businesses, etc. Also, in ensuring the adequacy of financial reporting, an internal control system structure (so-called J-SOX with reference to the COSO-ERM framework (COSO Enterprise Risk Management - integrated framework) that complies with the Financial Instruments and Exchange Act has been established and is in operation.