Management Conscious of Cost of Capital and Stock Price

Management Conscious of Cost of Capital and Stock Price

The Company conducts an analysis and evaluation of capital profitability and market valuation every fiscal year.

Based on these results, the Company determines and promotes policies and measures designed to enhance corporate value.

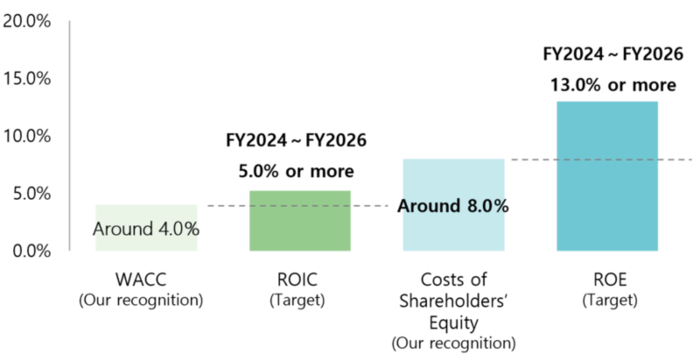

Under the current Medium-Term Management Plan "Further Evolution 2026" (December 2023 - November 2026), the Company recognizes the cost of capital (market expected return) to be approximately 8% and WACC to be approximately 4%.

Aiming to maintain capital profitability exceeding these levels, the Company has set a quantitative target of achieving an ROE of 13% or higher.

Regarding capital allocation, the Company considers growth opportunities, domestic and international business environments, and capital profitability, and optimally allocate funds to growth investments that serve as sources of future earnings, the maintenance of financial soundness, and shareholder returns.

Furthermore, the Company has set an equity ratio of approximately 35% and a Net D/E Ratio of 1.4 times as management indicators, while pursuing financial soundness and capital efficiency, the Company targets growth by maintaining a portfolio balance between Trading Business and Stable Business.

Efforts for Corporate Value Enhancement

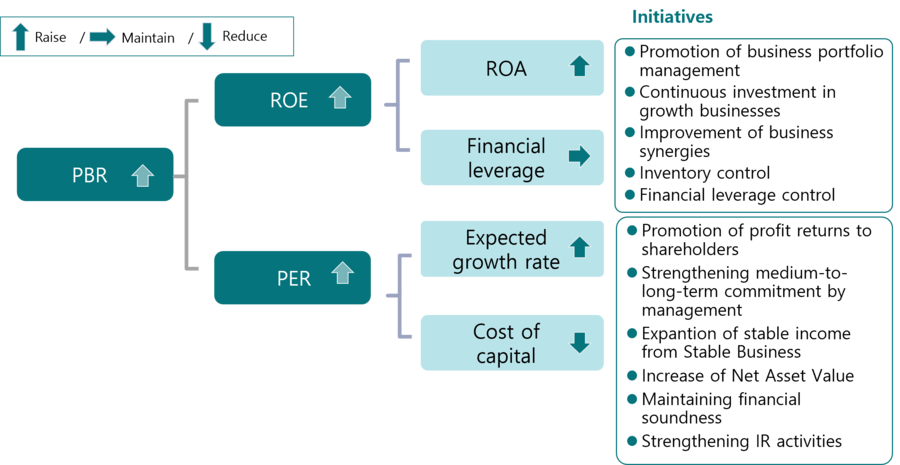

Regarding the improvement of market valuation, the Company is utilizing a logic tree to organize measures directed toward at improving PBR.

Through this approach, the Company is promoting initiatives such as reducing the cost of capital and improving PER, thereby striving to enhance shareholder value.

Logic tree for improving PBR

Please refer to the following documents for details on our initiatives.