Corporate Governance

Fundamental Approach Toward Corporate Governance

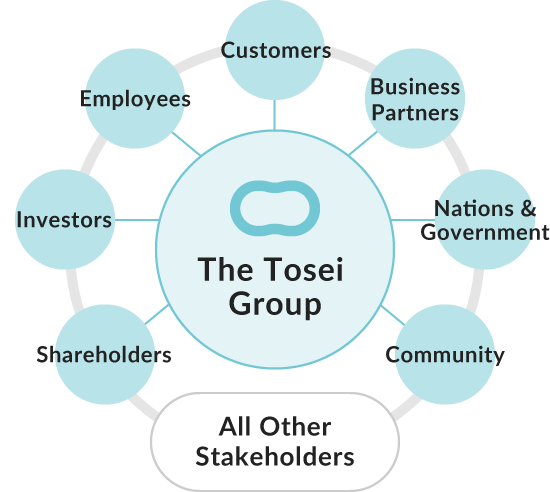

Our Group aspires to be a valuable contributor to all of our stakeholders in society including the shareholders, the employees, the business partners and others, by promptly and appropriately responding to the changes in the business environment and continuing operational activities which enable the Group to achieve a sound growth. For this purpose, the Group has placed the greatest importance on enhancement of corporate governance, and in particular, "fully cultivating a compliance mindset," "enhancing risk management" and "conducting timely disclosure" as three key initiatives. Furthermore, the Group is determined to make efforts in a unified manner, from the top management down to each employee of the Group companies, led by the Board of Directors, to develop an internal control system as required by the Companies Act and the Financial Instruments and Exchange Act, as well as to set up a system which is credible to investors, as a financial instruments business operator.

Three Important Items in Corporate Governance

-

Compliance

We place compliance at the top of our agenda and raise awareness of it from top management to all employees of the Group companies.

-

Risk Management

Assuming every possible risk, we prepare and practice emergency responses under normal conditions with a special focus on eliminating relationships with anti-social forces.

-

Information Disclosure

We practice disclosure and communication appropriately and on a timely basis to all stakeholders including shareholders.

Basic Policy on Corporate Governance

Corporate Governance Report

Corporate Governance System

Reasons for Adopting the Current Corporate Governance System

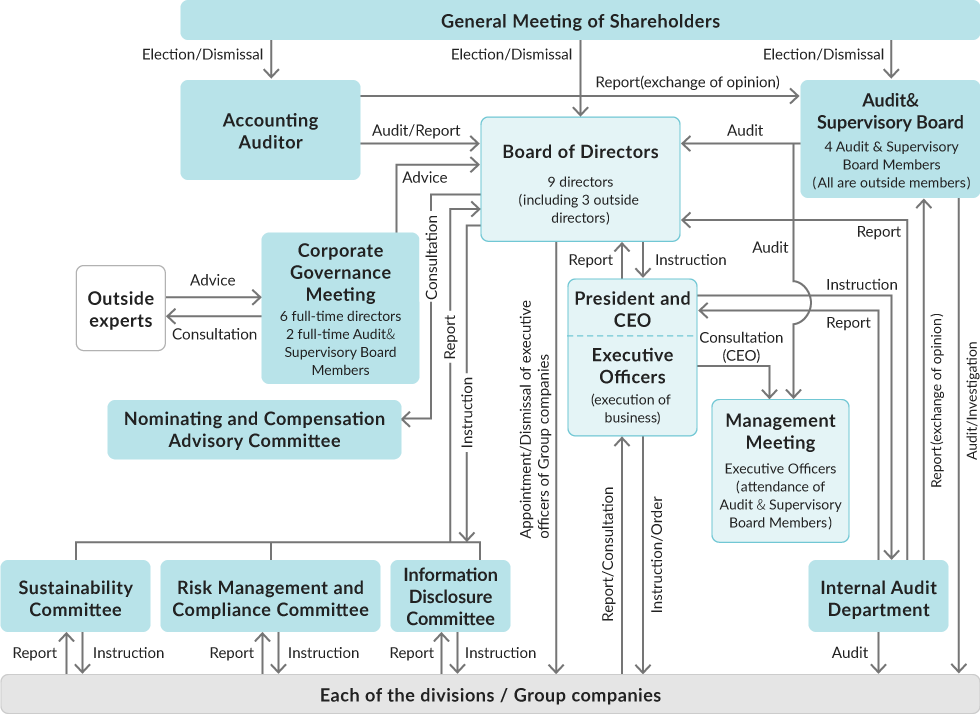

The Company has set up the Board of Directors and the Audit & Supervisory Board. While appointing from outside its outside directors and all of its Audit & Supervisory Board members, it has also adopted an executive officer system, for the purpose of operating its businesses with high transparency. All of the Audit & Supervisory Board members of the Company have been outside Audit & Supervisory Board members since the time of listing. The Audit & Supervisory Board members have always performed audits of the business management of the Company from the viewpoints of ensuring and increasing the Company's corporate value and the common interests of its shareholders. The Company further enhances its supervisory function over its management by inviting outside directors to the Board of Directors. On the management side, the Company has employed the executive officer system so as to achieve optimal distribution of decision-making functions and operational duties, as well as encouraging the delegation of authority in executing the businesses, in an attempt to strengthen its corporate governance.

Board of Directors

The Board of Directors is constituted by nine directors, three of whom are outside directors. As the highest management decision-making body, the Board of Directors makes resolutions on management policies and material issues and also supervises the execution of duties by the directors. In addition, the outside directors (the independent directors), by sharing their opinions from their objective standpoint, provide advices and suggestions to ensure the adequateness and appropriateness of the decisions made by the Board of Directors.

Nominating and Compensation Advisory Committee

The Company established the Nominating and Compensation Advisory Committee voluntarily as a consultative body to the Board of Directors to ensure appropriateness and transparency in such matters as the election process for proposals for director candidates submitted to the General Meeting of Shareholders and resolutions of the Board of Directors relating to allocation of remuneration, etc. to individual directors. The constituent members of the committee include an Outside Director(s) (independent director(s), one person or more), a full-time Audit & Supervisory Board member (outside audit supervisory board member, one person), Representative Director (one person), and a full-time Director (one person). The Outside Director who is a member of the committee is the chairperson of the committee.

To monitor the legality of each decision-making process, the Company's Basic Policy on Corporate Governance stipulates that the committee shall include an independent outside Audit & Supervisory Board member and that independent Outside Directors and independent outside Audit & Supervisory Board members shall be a majority of the committee. To ensure the independence and objectivity of the committee, four of the six committee members are independent officers, and the chairperson is an independent Outside Director.

Executive Officer System

The Company adopts the executive officer system in order to further segregate the monitoring/supervision of the Company's business management, which is the duty and responsibility of the directors, from the execution of the business. All executive officers are appointed by the Board of Directors and will adhere to the Company's internal rules and regulations as well as to the resolutions of the Board of Directors in executing and controlling the business operations of the Company. In addition, the representative director and president has assumed the position of the chief executive officer and holds the management meetings twice a month as a general rule, where consultation on the material issues to be decided by him are made as well as discussions on the matters to be resolved by the Board of Directors in advance.

Corporate Governance Meeting

With the aim of continuously strengthening its corporate governance, the Company holds monthly Corporate Governance Meetings constituted by full-time Directors and full-time Audit & Supervisory Board members. At the meetings, the Directors and the Audit & Supervisory Board members review and discuss the corporate governance concerns and the internal control matters in an effort to enhance the corporate value of the Company, and where necessary, they receive advices from the outside experts such as corporate attorneys and/or certified public accountants.

Audit & Supervisory Board

The Company has adopted the Audit & Supervisory Board member system and has the Audit & Supervisory Board with two full-time and two part-time Audit & Supervisory Board members, all of whom are outside Audit & Supervisory Board members. They audit the operation of the Board of Directors and execution of duties of Directors from an independent and objective standpoint, and provide constructive advice and recommendations for the increase of corporate value with their knowledge.

Cooperation Among the Audits by Audit & Supervisory Board Member, Internal Audit Member, and Audits by Accounting Auditors (Three-pronged Auditing Structure)

|

Audits by corporate auditors |

The auditing activities by the Audit & Supervisory Board members are performed in accordance with an annual audit plan. By cooperating with the accounting auditors as well as with the Internal Auditing Department, the Company has developed an efficient and viable auditing system. The full-time Audit & Supervisory Board members holds regular meetings with each of the directors and officers in charge of each department to fully understand the status of the business execution as well as to regularly exchange opinions with the outside directors. |

|---|---|

|

Internal audits |

The Internal Audit Department under the direct supervision of the chief executive officer, performs audits for the entire Group's overall business activities from the perspective of legality and adequacy, etc. in accordance with their annual auditing plan. In the event any inadequacy is discovered, recommendations for corrective actions are made to the audited departments. The internal Audit Department discusses with the audited departments for issues in need of corrective actions, and follows up with specific guide which leads to the provision of effective audits. |

|

Audits by the accounting auditor (Shinsoh Audit Corporation) |

The audit of the Company's accounts is performed based on the annual audit plan. In addition to the full-year audit performed at the end of the fiscal year, Company's Audit Company (Shinsoh Audit Corporation) conducts reviews at the end of each quarter. The periodic replacement and re-engagement of the accounting auditor in accordance with the rules and regulations of the audit corporation under the Certified Public Accountants Act are operated as follows;

|

Constituent Member by Board (as of Feb. 28, 2024)

(◎Chairperson, 〇Constituent member, △Observer)

Scroll

| Name | Position | Meeting of Board of Directors | Audit & Supervisory Board | Nominating and Compensation Advisory Committee | Corporate Governance Meeting |

|---|---|---|---|---|---|

| Seiichiro Yamaguchi | President and CEO |

|

|

|

|

| Noboru Hirano | CFO and Senior Executive Officer |

|

|

|

|

| Hideki Nakanishi | Director, COO and Senior Executive Officer |

|

|

||

| Shunsuke Yamaguchi | Director, Managing Executive Officer |

|

|

||

| Hiroyasu Yoneda | Director, Managing Executive Officer |

|

|

||

| Hitoshi Oshima | Director, Executive Officer |

|

|

||

| Kenichi Shohtoku | Independent Director |

|

|

||

| Hiroyuki Kobayashi | Independent Director |

|

|

||

| Mai Ishiwatari | Independent Director |

|

|

||

| Hitoshi Yagi | Outside Audit & Supervisory Board member (full-time) |

|

|

|

|

| Toshinori Kuroda | Outside Audit & Supervisory Board member (full-time) |

|

|

|

|

| Tatsuki Nagano | Outside Audit & Supervisory Board member (part-time) |

|

|

||

| Osamu Doi | Outside Audit & Supervisory Board member (part-time) |

|

|

Attendance at Meetings of the Board of Directors, Nominating and Compensation Advisory Committee, and Audit & Supervisory Board (FY2023)

Scroll

| Name | Position | Board of Directors Meetings (Attendance/Number of meetings) | Nominating and Compensation Advisory Committee (Attendance/Number of meetings) | Audit & Supervisory Board (Attendance/Number of meetings) |

|---|---|---|---|---|

| Seiichiro Yamaguchi | President and CEO | 22/22 | 2/2 | - |

| Noboru Hirano | CFO and Senior Executive Officer | 22/22 | 2/2 | - |

| Hideki Nakanishi | Director, COO and Senior Executive Officer | 22/22 | - | - |

| Masaaki Watanabe | Director, Managing Executive Officer | 22/22 | - | - |

| Shunsuke Yamaguchi | Director, Executive Officer | 22/22 | - | - |

| Hitoshi Oshima | Director, Executive Officer | 22/22 | - | - |

| Kenichi Shohtoku | Outside Director | 22/22 | 2/2 | - |

| Hiroyuki Kobayashi | Outside Director | 20/22 | 2/2 | - |

| Masao Yamanaka | Outside Director | 19/22 | 2/2 | - |

| Hitoshi Yagi | Outside Audit & Supervisory Board member (full-time) | 22/22 | 2/2 | 16/16 |

| Toshinori Kuroda | Outside Audit & Supervisory Board member (full-time) | 22/22 | - | 16/16 |

| Tatsuki Nagano | Outside Audit & Supervisory Board member (part-time) | 21/22 | - | 16/16 |

| Osamu Doi | Outside Audit & Supervisory Board member (part-time) | 21/22 | - | 16/16 |

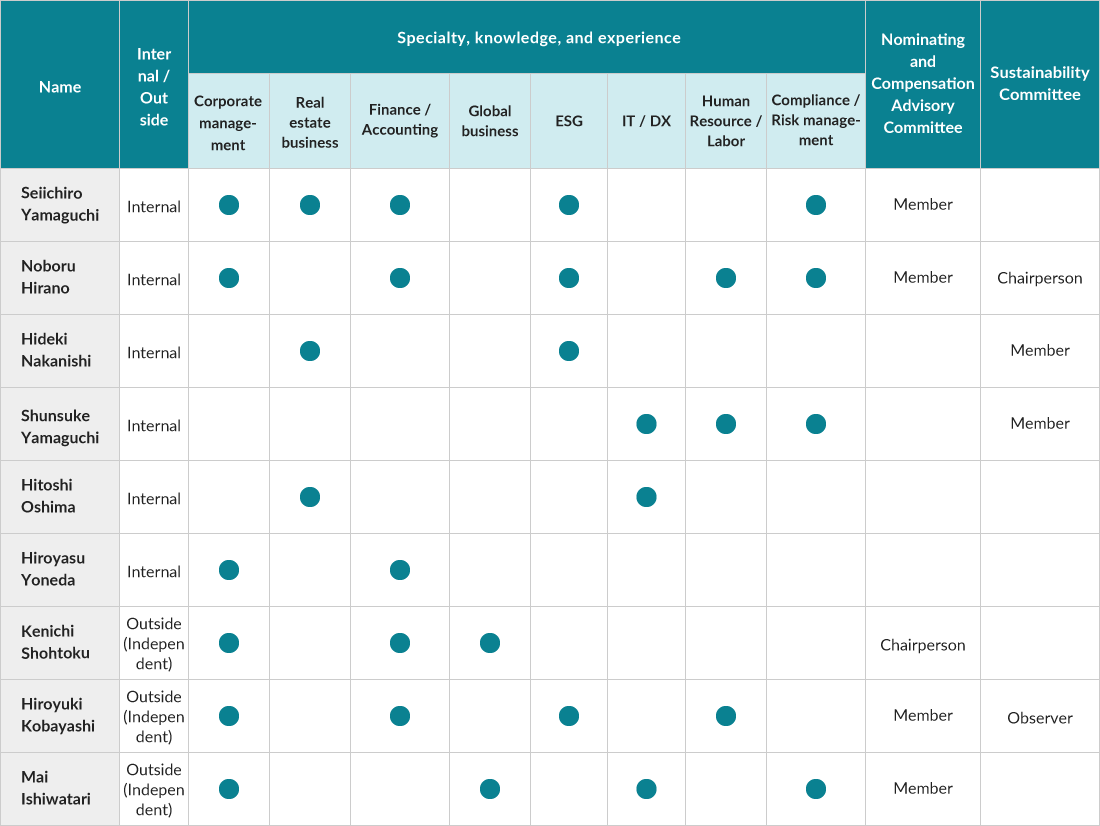

Policy for Appointment of Directors

Basic Policy

The Board of Directors places importance on diversity in terms of gender, internationality, work experience, age, etc. and is comprised of Directors who are familiar with the Group's philosophies, the details of finance and business, etc., and Independent Outside Directors having a wide range of experience and knowledge, and being independent.

When nominating candidates for the Board of Directors, those who have the necessary knowledge as Directors and are familiar with the Group's finances, business, and other aspects of the Group are nominated for Directors who execute the business. For Outside Directors, persons who can be expected to supervise management from an independent and objective standpoint and provide constructive advice and suggestions to Directors concurrently serving as Executive Officers are nominated. The candidates are determined based on the result of discussion regarding appropriateness of nomination of candidates at the Nominating and Compensation Advisory Committee.

In addition, for the nomination of candidates for the Audit & Supervisory Board members, the Company has a basic policy to nominate persons who can audit the operation of the Board of Directors, execute duties of directors from an independent and objective standpoint, and provide constructive advice and recommendations to enhance corporate value with their knowledge. The Board of Directors determines the candidates based on the result of discussion at the Nominating and Compensation Advisory Committee with the consent of the Audit & Supervisory Board. The Audit & Supervisory Board members of the Company are all appointed from outside since the time of listing.

Skill Matrix for the Board of Directors

Status of Independent Officer

Outside Directors and Outside Audit & Supervisory Board members are elected based on the Company's "Independence Standards." With regard to the nomination of Outside Directors, the Company elects persons who has a wide range of experience and knowledge, and can provide frank, lively and constructive opinions, advice and recommendations at the meeting of the Board of Directors.

Reasons for Election of Outside Directors and Outside Audit & Supervisory Board Members

Reasons for Election of Outside Directors

Scroll

| Name | Independent Officer | Reason for the election |

|---|---|---|

| Kenichi Shohtoku |

|

Outside Director Kenichi Shohtoku, a certified public accountant, he has an extensive experience and knowledge including those relating to overseas business. He has provided invaluable advice on various occasions such as the Board of Directors' meetings of the Company, liaison meetings with the Audit & Supervisory Board Members of the Company, etc. and has worked energetically to enhance the governance system of the Company and the Group as well as to ensure the appropriateness of financial reporting. The Company considers that he is indispensable for the maintenance and improvement of corporate governance structure for further expansion of the Group and enhancing the checking functions in the future while paying attention to ESG issues. |

| Hiroyuki Kobayashi |

|

Outside Director Hiroyuki Kobayashi, has extensive experience and expert knowledge, accumulated mainly at major financial institutions. With his objective monitoring and proposals based on his abundant experience and expertise, he has been contributing to more active discussion at Board of Directors meetings and improvement of its effectiveness. The Company considers that he is indispensable for the maintenance and improvement of corporate governance structure for further expansion of the Group and enhancing the checking functions in the future while paying attention to ESG issues. |

| Mai Ishiwatari |

|

Outside Director Mai Ishiwatari possesses a high level of expertise and global knowledge of corporate legal affairs accumulated mainly at domestic and international law firms. Accordingly, we believe that she will be able to provide objective supervision and proposals that will contribute to legal compliance of the Group's business. Furthermore, she has been involved in corporate management at multiple companies in recent years. The Company believes that she will be able to contribute to the Group's further growth and enhancement of corporate governance by adopting her external viewpoint based on her knowledge and experience to ensure neutrality in management. |

Outside Audit & Supervisory Board Members

Scroll

| Name | Independent Officer | Reason for the election |

|---|---|---|

| Hitoshi Yagi |

|

Full-time Outside Audit & Supervisory Board member Hitoshi Yagi has extensive experience in the auditing divisions of major financial institutions and professional insight based on his qualifications as a Certified Internal Auditor (CIA) and a Certified Information Systems Auditor (CISA). Utilizing such experience and knowledge, the Company believes that he can perform his role to ensure the adequacy and appropriateness of the Company's management. |

| Toshinori Kuroda |

|

Full-time Outside Audit & Supervisory Board member Toshinori Kuroda has abundant experience at major financial institution as well as specialist knowledge based on his qualification as Master of Business Administration (MBA) and Certified Internal Auditor (CIA). Utilizing such experience and knowledge, the Company believes that he can perform a role in ensuring the adequacy and appropriateness of the Company's management. |

| Tatsuki Nagano |

|

Outside Audit & Supervisory Board member Tatsuki Nagano has experience at major financial institutions and continues to be involved in corporate management. Based on his extensive experience and high level of expert insight, the Company believes he can perform a role in ensuring the adequacy and appropriateness of the Company's management. |

| Osamu Doi |

|

Outside Audit Supervisory Board member Osamu Doi has abundant experience at major security companies and at companies that conduct investment banking activities as well as specialist knowledge. Based on such experience and knowledge, the Company believes that he can perform a role in ensuring the adequacy and appropriateness of the Company's management. |

Independent Officers' Remuneration

Outline of the Remuneration System for Directors and Policy for Determining Remuneration

The Company has a basic policy to properly determine remuneration, through a combination of fixed remuneration based on job responsibility, a performance-based bonus, stock options that allow exercise of rights after a certain period, and the Company's share-based compensation depending on the performance result of a certain period in order to realize the medium- to long-term growth of the Group.

Remuneration for full-time Directors consists of monetary remuneration, comprising a "fixed salary" which is scaled according to duties, "performance evaluation remuneration" which is based on the achievement of individual goals such as the performance of each full-time Director, and "directors' bonuses" which are linked to consolidated profit before tax, "share-based compensation" which are linked to consolidated profit before tax, and "stock options" which are aimed to increase the desire and motivation to contribute to the medium- to long-term enhancement of corporate value.

Due to the emphasis on their supervisory function from a standpoint independent of the execution of business, Outside Directors' remuneration is composed of a "fixed salary", "share-based compensation" which amount is fixed, and "stock options" only. No "performance evaluation remuneration" or "directors' bonuses" are paid to Outside Directors. The ratio of fixed salary to performance-linked renumeration (including share-based compensation) for full-time Directors is kept around 60:40.

The representative director and president drafts proposals for each Director's remuneration within the limit, which are discussed by the Nomination and Compensation Advisory Committee, before being decided by resolution of the Board of Directors.

Matters Resolved at the Ordinary General Meeting of Shareholders Regarding Remuneration etc. of Directors

The maximum amount of remuneration etc. for Directors and Audit & Supervisory Board members per year is set as follows.

According to the Articles of Incorporation, the number of Directors shall be 12 or less, and the number of Audit & Supervisory Board members shall be 6 or less.

Scroll

| Position | Remuneration type | Maximum amount of remuneration, maximum number of shares | Date of resolution of the ordinary general meeting of shareholders |

|---|---|---|---|

| Directors | Fixed salary, performance evaluation remuneration, directors' bonuses |

¥500 million or less per year (including ¥80 million or less for outside directors. Salaries for employees are not included) |

February 26, 2020 (70th Ordinary General Meeting of Shareholders) |

| Stock options | ¥100 million or less per year (including ¥10 million for outside directors) |

February 27, 2019 (69th Ordinary General Meeting of Shareholders) |

|

| Share-based compensation | Full-time directors: 100,000 or less of the Company's ordinary shares and ¥200 million or less per year Outside directors: 10,000 or less of the Company's ordinary shares and ¥20 million or less per year |

February 27, 2024 (74th Ordinary General Meeting of Shareholders) |

|

| Audit & Supervisory Board members | Fixed salary | ¥60 million or less per year | February 28, 2004 (54th Ordinary General Meeting of Shareholders) |

Fixed Salary

On the basis of comparisons with the results of surveys of Directors' remuneration at listed companies, conducted by external specialist agencies, and surveys of the levels of Directors' remuneration at the Company's competitors, conducted by the Company, as well as comparison with the highest amounts of remuneration paid to employees of the Company, the Company has established fixed salary scaling guidelines, based on Directors' duties and posts held by Directors concurrently serving as Executive Officers. Remuneration for each individual Director is discussed by the Nomination and Compensation Advisory Committee, before being decided by the Board of Directors.

Performance Evaluation Remuneration (Performance-linked Renumeration)

The "performance evaluation remuneration" for full-time Directors is based on their individual achievement of single-year performance targets. A "standard evaluation remuneration amount" equal to 33% of the fixed salary is paid monthly together with the fixed salary. Where there is an adjustment based on the achievement of performance targets (of between +55% and -50% of the standard evaluation remuneration), this is added to and paid together with Directors' bonuses or deducted from Directors' bonuses after the conclusion of the Ordinary General Meeting of Shareholders held during the fiscal year. Remuneration for each Director is discussed by the Nominating and Compensation Advisory Committee, where the level of contribution to the governance practices and the pursuit of sustainability of the Company as well as the Group as a whole, achievement of the department in charge, and maintenance/improvement of consolidated management indicators (ROE, stock price, etc.) are evaluated, before being decided by the Board of Directors.

Director's Bonuses (Performance-linked Renumeration)

Directors' bonuses are determined based on the pre-determined level of consolidated profit before tax, plus an additional amount is determined based on the fixed salary (yearly amount) if the consolidated profit before tax target for a single fiscal year is achieved and are paid after the close of the Ordinary General Meeting of Shareholders for the relevant fiscal year. As Directors of a listed company engaged in consolidated management, the Company's Directors are charged with the most important tasks of maintaining and increasing the level of consolidated profit before tax and achieving the consolidated profit before tax targes each fiscal year.

Share-based Compensation

- Performance linked remuneration for full-time Directors

- In order to further clarify the linkage between remuneration for Directors and the Company's business performance and share value, and to continuously enhance the Company's corporate value, share-based remuneration for full-time Directors is granted in the form of a number of ordinary shares of the Company after the close of the Ordinary General Meeting of Shareholders for the relevant fiscal year, calculated according to the achievement of the level set according to the amount of consolidated profit before tax for a single fiscal year predetermined by the Board of Directors after discussion at the Nomination and Compensation Advisory Committee.

- Fixed salary for Outside Directors

- In order to continuously enhance the Company's corporate value, share-based remuneration for Outside Directors is granted in the form of the Company's ordinary shares after the close of the Ordinary General Meeting of Shareholders for the relevant fiscal year, subject to the achievement of the amount of consolidated pre-tax profit for a single fiscal year predetermined by the Board of Directors after discussion at the Nomination and Compensation Advisory Committee.

The ordinary shares granted to full-time Directors and Outside Directors are subject to certain transfer restrictions such as the restriction to transfer until the date of their resignation from the position as Directors of the Company. Furthermore, the Company may forfeit the rights to receive the delivery of shares (malus) in the event of a serious violation of laws or internal rules and regulations.

Stock Options

In order to practice corporate management with a focus on enhancing corporate value over the medium- to long-term, the representative director and president drafts proposals for the number of stock options to be granted to each Director, based on the Director's duties as well as posts held concurrently by the Director as Executive Officer, for each medium-term management plan. These proposals are examined by the Nomination and Compensation Advisory Committee, before being decided by the Board of Directors. A fixed number of stock options are granted to Outside Directors, considering the importance of their management monitoring and supervisory function aimed at enhancing corporate value.

Auditor's Remuneration

Audit & Supervisory Board members, considering their role, are remunerated with a fixed salary only. Remuneration for each Audit & Supervisory Board member is decided through discussion of the Audit & Supervisory Board, within the limits of the maximum total amount.

Amount of Remuneration for Executive Officers (FY2023)

Scroll

| Position | Total amount of remuneration,etc. [¥ thousand] | Total amount by type of remuneration, etc. [¥ thousand] | Number of recipients [Person] | |||

|---|---|---|---|---|---|---|

| Basic remuneration | Performance-linked remuneration | Non-monetary remuneration, etc. | ||||

| Performance evaluation remuneration | Bonus | Stock Options | ||||

| Directors (of which outside directors) | 312,964 (21,000) |

176,353 (21,000) |

51,784 (-) |

84,826 (-) |

- (-) |

9 (3) |

| Audit & Supervisory Board members (of which outside audit & supervisory board members) | 33,960 (33,960) |

33,960 (33,960) |

- (-) |

- (-) |

- (-) |

4 (4) |

Internal Control System

The Company has established a Basic Policies of Internal Control Systems by resolution of the Board of Directors, and under this basic policies, in a continuous effort to develop the internal control system, the Company establishes plans for implementation and operation of the internal control system annually taking into consideration of revisions of relevant laws and regulations, changes in the business environment of the Group, expansion of the businesses, etc. Also, in ensuring the adequacy of financial reporting, an internal control system structure (so-called J-SOX with reference to the COSO-ERM framework (COSO Enterprise Risk Management - integrated framework)) that complies with the Financial Instruments and Exchange Act has been established and is in operation.